Some Ideas on Financial Education You Need To Know

Wiki Article

Financial Education - Truths

Table of ContentsFinancial Education for BeginnersThe Definitive Guide for Financial EducationNot known Incorrect Statements About Financial Education Financial Education for DummiesThe 6-Minute Rule for Financial EducationWhat Does Financial Education Do?All about Financial Education

It is very hard to gauge the amount as well as strength of personal financing guideline that is happening in individuals's homes, and also significant information on this topic is difficult to obtain for the hundreds of primary as well as center schools throughout the country. Best Nursing Paper Writing Service. Conclusive university information is similarly hard to discover in this field.In the area of this record entitled "Additional Credit rating: State Policies as well as Programs That Are Making a Difference," we try to offer you a small sampling of the lots of state efforts that are trying to bring individual money principles to K-8 youngsters and to young people in college or the work environment.

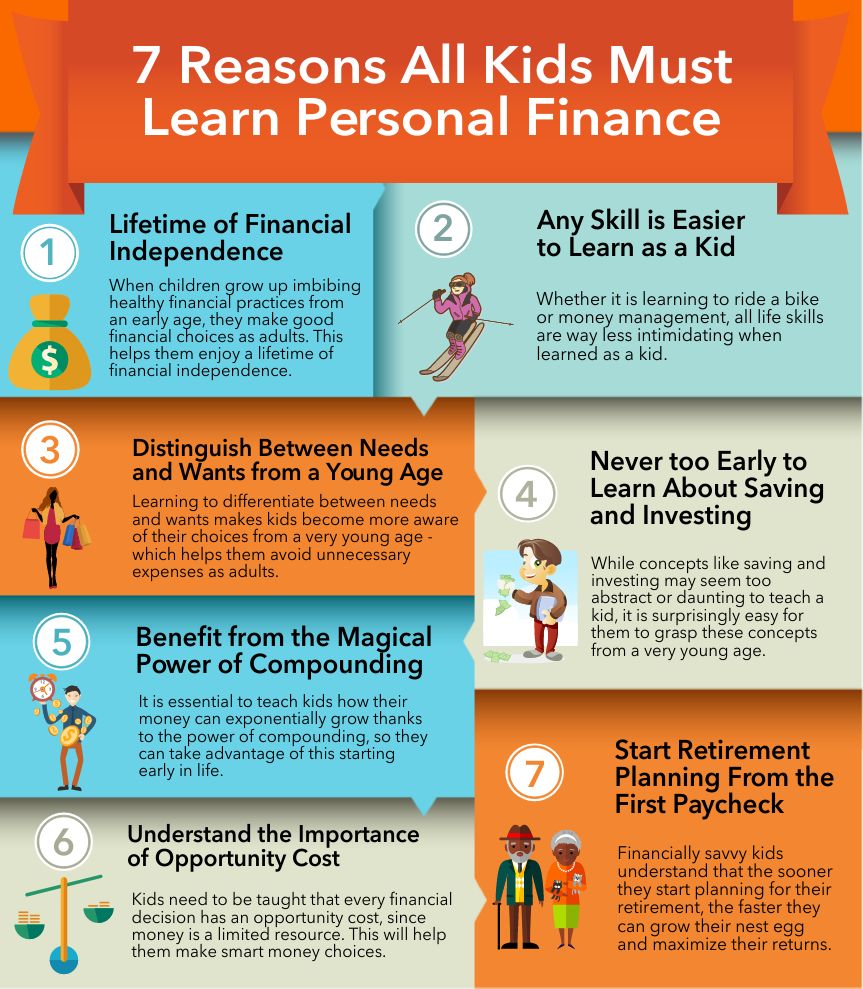

Kids are not learning more about personal money in the house. A 2017 T. Rowe Price Survey kept in mind that 69% of moms and dads have some unwillingness regarding going over monetary matters with their kids. 3 Actually, parents are nearly as unpleasant speaking to their kids concerning sex as they have to do with money. Only 23% of kids checked suggested that they speak with their parents frequently about money, and 35% mentioned that their moms and dads are uneasy speaking with them concerning money.

4 Easy Facts About Financial Education Explained

Having an exceptional debt rating might save a customer in unwanted of a $100,000 in rate of interest repayments over a lifetime (see: 's Life time Expense of Financial Debt Calculator). Financial proficiency causes far better individual finance actions. There are a range of research studies that indicate that people with greater levels of financial proficiency make far better personal finance choices.

It was discovered that mandated personal money education in secondary school boosted the credit rating ratings and reduced the default prices of young adults. There was no quantifiable modification in the bordering states over the very same period gauged. One more study shows that a well-designed individual finance program (one semester in length), taught by extremely trained teachers that went to a 30-hour week-long training program and also utilized a specific curriculum, boosted the typical individual finance expertise of the students in all common as well as principle areas covered by the scientists' analysis examination (Asarta, Hillside, as well as Meszaros, 2014).

A Biased View of Financial Education

Likewise, trainees that obtained official education by qualified instructors reported some enhancement in most personal finance behaviors determined. Undoubtedly, pupils that received personal finance education by qualified teachers had "high monetary proficiency" on the same level with the proficiency levels of Generation X (ages 35 to 49) as well as greater than that of older Millennials (ages 18 to 34) (Champlain University's Facility for Financial Literacy, 2015).We would certainly not permit a young person to enter the vehicle driver's seat of a car without calling for vehicle driver's education and learning, as well as yet we enable our youth to get in the complicated financial globe with no associated education. An ignorant private armed with a charge card, a student car loan and also accessibility to a mortgage can be virtually as hazardous to themselves and their neighborhood as a person without training behind the wheel of a cars and truck.

Throughout the Federal Reserve System, we deal with the Jump$sharp Coalition-- in your area with the Washington, D.C., chapter and also through partnerships between the Get Banks and various other state phases of the coalition-- to attain our shared objectives. The partnership between the Federal Book and the Dive$sharp Coalition is a natural one. Leap$tart's objective to create find out a much more economically literate populace supports the Federal Book's objective of a steady and also expanding economic situation.

The Financial Education Statements

As pupils independently form homes or begin organizations, their cumulative choices will certainly shape the economy of our future. I am particularly delighted to be able to represent the Federal Book in this initiative as my individual dedication to monetary proficiency has covered greater than thirty years. I have actually been included with a variety of efforts consisting of some that took me right into the class to instruct trainees directly as well as others that offered instructors with tools and training to better prepare them to teach economics and individual money.They require to recognize just how to spending plan and save and also just how to choose the most effective investment vehicles for their savings. And also as the current economic chaos has actually shown us, they should special info understand how to plan for and also take care of monetary contingencies such as joblessness or unforeseen expenses (Best Nursing Paper Writing Service). Leap$sharp supports initiatives to offer such an education.

In enhancement to giving materials for financial education and learning, the Federal Book has additionally begun to assess the performance of the education programs it participates in, to make sure that we can better review the end results of our efforts. This study is meant to help us much better answer the inquiry, "What operates in education and learning?" That we may allot our resources in the ideal possible fashion.

Some Known Factual Statements About Financial Education

The Federal Get is the primary government firm billed with writing guidelines controling customer financial products. Historically, we have actually concentrated on disclosure as the very best way to supply customers with details to choose between products or to make choices concerning making use of economic products. In the last few years, we have utilized considerable customer testing to gauge consumers' understanding of monetary disclosures as well as to highlight techniques that just can not be recognized by customers despite the very best disclosures.Recently, the Federal Reserve has composed strong brand-new consumer security policies for home loans, credit report cards, and also over-limit fees. As well as we have enhanced our reaction time for preparing guidelines to deal with emerging trends that may pose brand-new threats for customers. In closing, I would certainly like to say thanks to the educators here today for your devotion to Washington-area pupils.

I delight in to be a component of this conversation among the exclusive and also public markets, in addition to the education area, concerning exactly how finest to empower students with the self-confidence as well as savvy to navigate their economic globes.

Financial Education Fundamentals Explained

For better ideas for local business owner, comply with Every, Revenue on Facebook, Twitter, as well as Linked, In.

Top Guidelines Of Financial Education

By- Payal Jain, Owner and CEO, Funngro As a teen, have you ever before seen your parents going over something pertaining to money, and when you try to sign up with the discussion, they either switch the topic or state something like "we are doing something crucial, do not disturb". The majority of us question why they do this, why can not we recognize concerning money? Well, you are not exactly economically literate, so rather truthfully, they believe it would certainly be of no aid at the moment.Report this wiki page